Loading

Get Aglc108872 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AGLC108872 online

This guide provides concise and clear instructions for users on how to complete the AGLC108872 form online. Whether you have prior experience or not, the following steps will ensure a smooth process.

Follow the steps to successfully complete the AGLC108872 form.

- Click ‘Get Form’ button to obtain the AGLC108872 form and open it in your document editor.

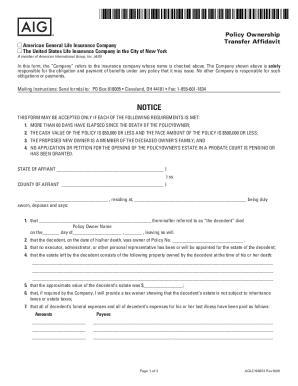

- Begin by carefully reading the notice on the first page to ensure that the requirements for submission are met, including the eligibility criteria related to the policy and the estate.

- In Section 1, state the name of the decedent (the person who passed away) and the date of their death accurately.

- In Section 2, provide the specific policy number that pertains to the life insurance in question.

- In Section 3, confirm that no executor or personal representative has been appointed for the decedent's estate.

- Section 4 requires you to describe the property owned by the decedent at the time of their death. List all properties clearly.

- In Section 5, indicate the approximate value of the decedent's estate, being as accurate as possible.

- Section 6 may require you to ensure that if a tax waiver is necessary, it will be provided to confirm that no taxes are due on the estate.

- In Section 7, detail the funeral expenses and last illness costs, including amounts and payees.

- Section 8 should include any unpaid debts of the decedent or their estate, if applicable.

- Next, in Section 9, list the names, relationships, ages, and residences of all relatives who were alive at the time of the decedent’s death.

- Review Section 10 to verify that all heirs-at-law are included and that no other persons can claim an interest in the estate.

- Confirm that Section 11's requirements are still met at the time of signing.

- In Section 12, sign the affidavit to support the transfer of ownership.

- Complete Sections 13 and 14 regarding indemnity agreement and acknowledgment.

- After completing all sections, ensure to add your signature in the space provided and fill in your relationship to the deceased, phone number, address, social security number, and email address in the designated areas.

- Finally, save your changes, and choose to download, print, or share the completed form as necessary.

Complete the AGLC108872 online today to ensure compliance and proper documentation.

In general, life insurance death benefits are exempt from taxation. If, however, you transfer a life insurance policy to another party in exchange for money or any other kind of material consideration, the death benefit proceeds may become fully or partially taxable. This is known as the transfer-for-value rule.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.