Loading

Get Az Form 111 2007-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AZ Form 111 online

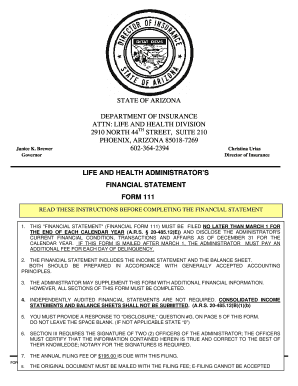

Filling out the AZ Form 111 online may seem daunting, but this guide will walk you through each step to ensure accuracy and compliance. This form is crucial for administrators in the life and health insurance sector to report their financial condition annually.

Follow the steps to successfully complete the AZ Form 111 online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Complete Section I (Income Statement) by providing your administrator's name as noted on your certificate of registration and the AZ company code number. Fill in the income details, including operating income and any additional income sources.

- Continue filling out Section I by detailing operating expenses such as salaries, rent, and any other relevant expenditures. Ensure all sections are filled correctly and completely.

- Proceed to Section II (Balance Sheet) and enter the required information for current assets, fixed assets, investments, and other assets. Follow the same format for liabilities and stockholder's equity.

- In Section G (Disclosure), be sure to state the total amount of Arizona funds handled on behalf of insurers for the calendar year. Avoid leaving this section blank; if not applicable, enter '0'.

- Complete Section III by obtaining notarized signatures from two officers of the administrator. This attestation is critical to verify the accuracy of the report.

- Review the entire form to ensure all information provided is correct. Don't forget to include the annual filing fee of $195.00.

- After finalizing your form, you can save changes, download, print, or share the completed AZ Form 111 as required.

Start filling out the AZ Form 111 online to ensure compliance with reporting requirements.

Filing Form 120S late may result in a penalty based on the taxes owed and the duration of the delay. Arizona imposes a minimum penalty, which can increase if the form remains unfiled. To avoid unnecessary penalties, it's advisable to file on time and ensure your submissions, including AZ Form 111, are accurate and complete.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.