Loading

Get Cbdt E Payment Request Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cbdt E Payment Request Form online

Filling out the Cbdt E Payment Request Form online is an essential step for users seeking to make online tax payments to the Central Board of Direct Taxes. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to complete the Cbdt E Payment Request Form online.

- Click the ‘Get Form’ button to access the Cbdt E Payment Request Form and open it in your preferred editor.

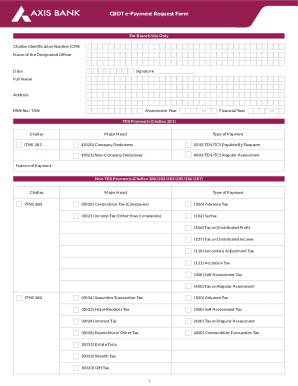

- Begin by filling out the 'For Branch Use Only' section, entering the Challan Identification Number (CIN), name of the designated officer, and the date in the specified format.

- In the 'User Information' section, provide your full name, address, Assessment Year, PAN/TAN number, and Financial Year.

- Select the appropriate payment type by indicating if it is for TDS (Challan 281) or Non-TDS payments (Challans 280/282/283/285/286/287). Ensure you pick the correct major head based on the type of payment applicable.

- Fill in the 'Payment Details' by specifying the tax amount, any surcharges, education cess, interest, penalties, and other applicable amounts. Ensure the 'Total' is accurately calculated.

- In the 'Payment Instructions' section, indicate the cheque number, and provide your current account number with Axis Bank. Clearly state the amount towards the Cbdt e-Payment.

- Acknowledge that the bank will process the payment on your behalf and that the submission of this form does not guarantee payment unless funds are available.

- Lastly, enter your contact number, the name of the authorized signatory, and ensure to review all entered information for accuracy before submission.

Complete your Cbdt E Payment Request Form online today to ensure your tax payments are processed efficiently.

Online Step 1: Visit the official income tax e-filing website. Income tax e-filing website. ... Step 2: This step includes filling up the details of the deductee. ... Step 3: Choose from either option under types of payment - Step 4: Verify all the details in the challan generated and make the payment using a payment method.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.