Loading

Get Al Form Ren 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AL Form REN online

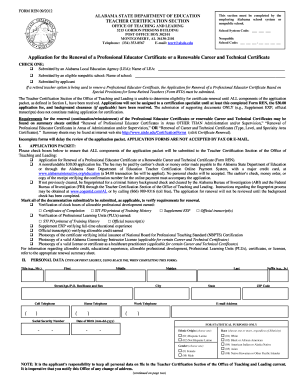

Filling out the AL Form REN for the renewal of a professional educator certificate can be an essential step in your career as an educator in Alabama. This guide provides step-by-step instructions to help you complete the form online accurately and efficiently.

Follow the steps to successfully fill out the AL Form REN.

- Press the ‘Get Form’ button to access the AL Form REN and open it in your preferred online editor.

- In the school system code field, enter the appropriate three-digit code assigned to your employing Alabama school system or nonpublic school.

- Choose the correct option for submission: either submitted by an Alabama Local Education Agency, an eligible nonpublic school, or the applicant themselves.

- If you are using the retired teacher option, ensure that you have Form RTD ready for submission alongside this form.

- Complete the personal data section with your title, first name, middle name, maiden name (if applicable), last name, suffix, and all contact information requested, ensuring that it is legible and accurate.

- Check the appropriate box to indicate whether you are applying for continuation or reinstatement of your certificate.

- Detail your educational history in the provided sections by listing colleges or universities attended, degrees earned, and your major.

- Provide a record of your previous educational experience, making sure to start with the most recent experience and exclude student teaching or substitute experiences.

- Indicate any certifications or alternative certificates issued to you in other states.

- Complete the testing section, if applicable, by stating the tests you need to take or have taken, as prescribed upon review of your application packet.

- Answer the citizenship or national status declaration truthfully and ensure that any responses requiring further explanation are well-documented and attached.

- Finally, review your completed form for accuracy, save your changes, and prepare to download, print, or share the form as needed.

Start completing your AL Form REN online today to ensure your certificate renewal process is seamless.

You should mail Alabama Form 65 to the Alabama Department of Revenue at the address specified in the form’s instructions. Double-check that you have included all required documents. Using resources like uslegalforms can help clarify where to send your forms, including the AL Form REN. This ensures a smooth submission process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.