Loading

Get Al Form 291 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AL Form 291 online

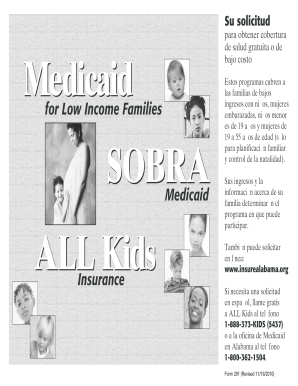

Filling out the AL Form 291, which facilitates access to health coverage for low-income families, is a straightforward process. This guide provides a step-by-step approach to ensure you accurately complete the form online and submit your application with confidence.

Follow the steps to fill out the AL Form 291 online successfully.

- Click ‘Get Form’ button to access the AL Form 291 and open it in the editor.

- Begin with the 'Applicant' section where you will provide the full name of the applicant, which may include a parent, guardian, or pregnant individual. Also, include the social security number if applicable, your address, and contact information.

- Indicate whether you currently receive Medicaid in another state. If yes, cancel your current Medicaid before proceeding with the application for Alabama Medicaid.

- If applicable, fill out information regarding the pregnancy, including the expected due date and confirmation from a medical professional.

- List any medical expenses incurred in the last three months and the names of the patients for those expenses.

- Provide details about any health insurance coverage currently in place, including the name of the insurance company, policy number, and the insured individual.

- Indicate whether any household member is employed by the state or a public school.

- Complete the section related to family information, which may require names and Social Security numbers of all family members living in the household.

- Report on your household’s income, detailing the frequency and amount of payments, including any self-employment income or agricultural earnings.

- Indicate any expenses related to daycare for children or adults with disabilities, including the caregiver's name and payment details.

- Ensure that all information is accurately completed and review for any missing sections or required documents before submission.

- Once all sections are completed, save your changes. You can then download, print, or share the AL Form 291 for submission.

Complete the AL Form 291 online today to access essential health coverage for you and your family.

Yes, if your business is operating in Alabama, you must file a business privilege tax return, even if you also submit the AL Form 291 for personal taxes. This tax applies to entities doing business within the state. The requirements can be complex, and you may benefit from consulting resources like uslegalforms to ensure your return is properly filed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.