Loading

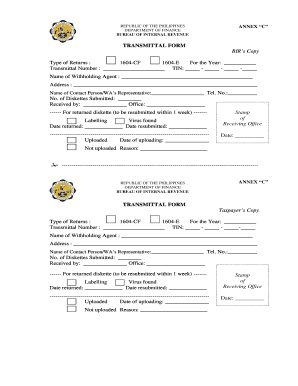

Get Transmittal Form Bir

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Transmittal Form Bir online

Filling out the Transmittal Form Bir accurately is essential for proper submission of tax documents. This guide provides clear instructions on how to complete each section of the form online, ensuring a seamless filing experience.

Follow the steps to complete the Transmittal Form Bir online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the 'Type of Returns' section, select either 1604-CF or 1604-E according to your needs. Ensure that you choose the correct type for accurate processing.

- Enter the year for which you are filing in the 'For the Year' field. Make sure to provide a four-digit year.

- Fill out the 'Transmittal Number' field with the appropriate number assigned to this transmittal.

- Input your Tax Identification Number (TIN) in the designated format: _____ - _____ - _____ - _____. Be sure to double-check for accuracy.

- Provide the 'Name of Withholding Agent' clearly, as this is crucial for identifying the responsible party.

- Enter the complete 'Address' of the withholding agent. This should include the street, city, state, and zip code.

- Complete the 'Name of Contact Person/WA’s Representative' and 'Tel. No.' fields to ensure effective communication regarding the submission.

- Indicate the 'No. of Diskettes Submitted' to account for the materials being filed. This is important for tracking purposes.

- In the 'Received by' and 'Office' fields, provide the name and office location of the individual who receives the documents.

- If applicable, fill out the returned diskette section, indicating any issues such as 'Virus found,' and note the required dates for return and resubmission.

- In the uploaded section, enter the date of uploading. If the submission was unsuccessful, provide a reason in the 'Not uploaded Reason' field.

- Finalize your form by reviewing all entered information for correctness. Save your changes and prepare to download, print, or share the form as needed.

Complete your documents online today for efficient filing.

BIR form 2316 or Certificate of Compensation Payment/Tax Withheld shows the breakdown of all the income received by an employee from his/her employer within the applicable calendar year. In addition to income, it also shows the government deductions as well as taxes withheld within the taxable period.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.