Loading

Get Form 6166-2019. Dept. Of The Treasury, Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 6166-2019. Dept. Of The Treasury, IRS online

Filling out the Form 6166-2019 is essential for entities seeking certification of tax exemption under U.S. tax law. This guide will provide detailed instructions to help users navigate the form efficiently.

Follow the steps to complete Form 6166-2019 effectively.

- Press the ‘Get Form’ button to access the form and open it in your document editor.

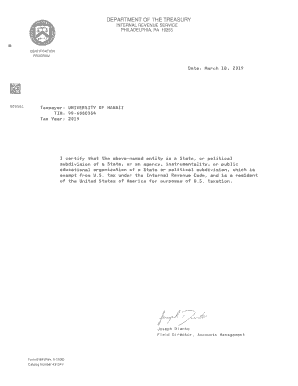

- Begin by filling out the taxpayer information section. This includes the name of the entity, which in this example is the University of Hawaii, and the Tax Identification Number (TIN), which is 99-6000354.

- Next, specify the tax year for which the certification is being requested. In this case, it is 2019.

- In the certification statement, confirm that the entity qualifies as a State, political subdivision, or public educational organization, and that it is exempt from U.S. tax under the Internal Revenue Code.

- Locate the signature section. The form requires the signature of an authorized official. The person signing should print their name and title below the signature. This confirms the accuracy of the information provided.

- Finally, ensure all information is correct. After completing the form, you may download it, save changes, print, or share it as needed.

Complete your Form 6166-2019 online and ensure your tax exemption certification is processed promptly.

To obtain Form 6166, a letter of U.S. Residency Certification, you must submit a completed Form 8802, Application for United States Residency Certification. A user fee is charged to process all Forms 8802.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.