Loading

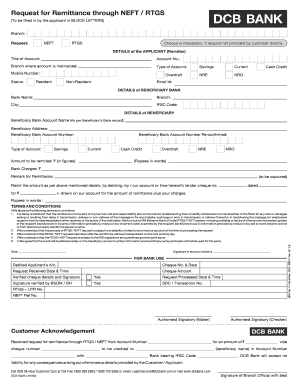

Get India Dcb Bank Request For Remittance Through Neft/rtgs 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the India DCB Bank Request for Remittance through NEFT/RTGS online

This guide provides comprehensive instructions on completing the India DCB Bank Request for Remittance through NEFT/RTGS. Whether you are familiar with digital banking or a first-time user, these step-by-step instructions will help you navigate the process with ease.

Follow the steps to successfully complete your remittance request.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin by selecting the branch from the drop-down menu or filling it in the designated field. This identifies the specific location associated with your account.

- Choose the type of remittance: NEFT or RTGS by marking the appropriate option.

- Fill in the details of the applicant (remitter) in BLOCK LETTERS. Include the title of the account, account number, branch, type of account, mobile number, status (overdraft, resident, non-resident, etc.), and email ID.

- Next, provide details of the beneficiary bank. This includes the bank name, branch, city, and IFSC code.

- Provide the beneficiary information. Fill in the account name as per the beneficiary's bank record, the beneficiary's address, account number, and confirm the account type (savings or current).

- Enter the amount to be remitted in figures and words, ensuring it matches for accuracy. Specify any bank charges that may apply.

- Add any remarks for the remittance in the designated field.

- Confirm the consent to remit the amount by debiting your account, or by providing the cheque number along with its date and drawn amount. Repeat the amount in words.

- Affix the date and provide your signature as the account holder where required.

- Finally, review all details for accuracy. Save your changes to store the document, and you can also download, print, or share the form as needed.

Complete your documents online to ensure a smooth remittance process.

Yes, Non-Resident Indians (NRIs) can utilize NEFT for sending remittances. They just need to ensure that their Indian bank account is enabled for such transactions, including those at India DCB Bank. This facility allows NRIs to make quick and convenient remittances back home, enhancing financial support for family and friends.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.