Loading

Get Form 527

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 527 online

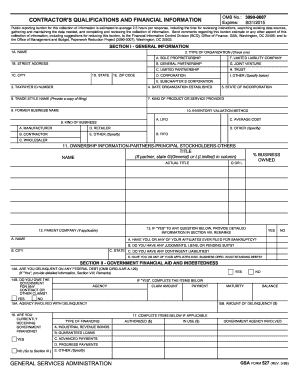

Filling out the Form 527 online can seem daunting, but with a clear understanding of each section, you can complete it efficiently. This guide provides expert analysis and step-by-step instructions tailored to your needs.

Follow the steps to successfully fill out the Form 527 online

- Press the 'Get Form' button to access the form and open it in your browser.

- In Section I, provide your general information: your name, type of organization, street address, city, state, and ZIP code. Ensure that all information is accurate and up-to-date.

- Continue in Section I by entering your taxpayer identification number, the date your organization was established, and any relevant trade style name. Also, indicate the kind of product or service you provide.

- In Section II, respond to questions about government financial aid and indebtedness. Indicate if you are delinquent on any federal debt and provide details of any claims or financial obligations.

- For Section III, submit your financial statements. If applicable, attach prepared financial statements in lieu of completing this section. Include information about your accountant if necessary.

- In Section IV, complete your income statement sections detailing your income, cost and expenses, and net income or loss for the relevant periods.

- Fill out Section V, providing banking and finance company information. Include the names of your banks, contact persons, amounts owing, and other relevant financial details.

- Section VI requires input about your principal suppliers. Provide their names, contact information, and any amounts owed.

- In Section VII, collect information on contracts you have in force, including details about the work type, amounts, and completion percentages.

- Finally, review all sections for accuracy before submitting. Use the available options to save changes, download, print, or share the completed form.

Complete your Form 527 online today and ensure all your information is accurate and up-to-date.

The $25,000 rental loss allowance is a provision that allows certain taxpayers to deduct up to $25,000 in rental losses against non-passive income. This allowance applies primarily to those who actively participate in managing the rental property. Form 527 can guide you through the requirements to qualify for this deduction.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.