Loading

Get Ut Urs Drwd-12 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT URS DRWD-12 online

This guide provides a detailed overview of how to fill out the UT URS DRWD-12 form online for requesting a withdrawal from your Roth IRA. Follow these steps to ensure accurate and efficient submission of your withdrawal request.

Follow the steps to complete your withdrawal request effectively.

- Click the ‘Get Form’ button to obtain the UT URS DRWD-12 and open it in the online editor.

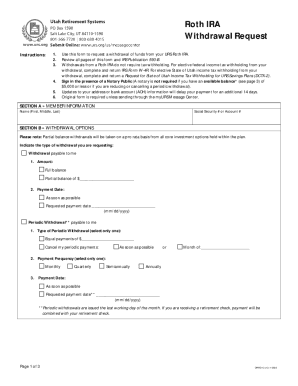

- Begin filling out Section A, which requires your member information, including your name and Social Security number or account number.

- Proceed to Section B to select your withdrawal options. Indicate whether you want a full or partial withdrawal and specify the amount and payment date.

- In Section C, indicate your preferred payment instructions, selecting either a check or ACH transfer to your bank account. Provide any necessary bank details.

- Complete Section D by signing and dating the form. A notary public is required unless your available balance is $5,000 or less or if you are cancelling a periodic withdrawal.

- Finally, review your completed form for accuracy, and save your changes. You may then download, print, or share your form as needed.

Complete your UT URS DRWD-12 form online for a smooth withdrawal process.

A distribution from a traditional IRA will be included in the owner's income as ordinary income and, depending on the owner's age, may also be subject to a 10% early distribution penalty.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.