Loading

Get Ut Urs Drwd-12 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT URS DRWD-12 online

This guide provides comprehensive, step-by-step instructions for filling out the UT URS DRWD-12 form online. By following these instructions, users can easily navigate the online form and ensure they have completed all necessary sections accurately.

Follow the steps to fill out the UT URS DRWD-12 online successfully.

- Click the ‘Get Form’ button to access the UT URS DRWD-12 form and open it in your preferred editor.

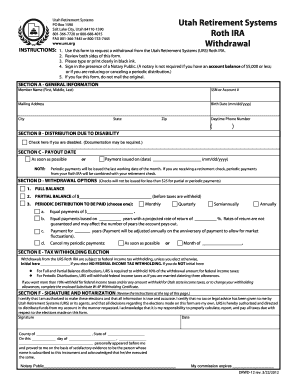

- In Section A, enter your general information clearly. This includes your full name, Social Security Number or Account Number, mailing address, birth date, city, state, zip code, and daytime phone number.

- Proceed to Section B. If you are a person with a disability, check the appropriate box. Be aware that documentation may be required.

- In Section C, select your preferred payout date. You can choose to receive funds as soon as possible or specify a date in the provided space.

- Move to Section D, where you will select your withdrawal options. Choose either 'Full Balance' or 'Partial Balance' and if applicable, indicate the specific amount for partial withdrawals. If selecting periodic payments, choose from monthly, quarterly, semiannually, or annually, and fill in the required details for each option.

- In Section E, complete the tax withholding election. Initial the appropriate box if you elect not to have federal income tax withheld. If you do not initial, be aware of the default withholding rates indicated.

- Finally, in Section F, sign and date the form in the presence of a Notary Public. If your account balance is $5,000 or less, notarization is not required.

- Once all sections are completed, you may save your changes, download, print, or share the form as needed.

Complete your UT URS DRWD-12 and other documents online for a streamlined experience.

You can roll over the amount that you withdrew to the Roth IRA or another of your Roth IRAs if the following conditions are met: The funds are rolled over within 60 days from when you received them. The Roth IRAs were not involved in a rollover during the 12 months preceding the date of the distribution.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.