Loading

Get Il Ui-3/40 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL UI-3/40 online

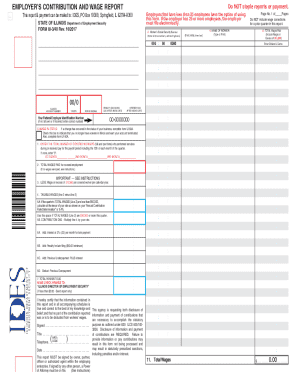

Filling out the IL UI-3/40 form online is a crucial step for employers submitting quarterly contributions and wage reports in Illinois. This guide provides comprehensive instructions to help you navigate each section of the form with ease and confidence.

Follow the steps to complete the IL UI-3/40 efficiently.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Enter your 7-digit UI account number and your 9-digit FEIN number in the appropriate fields to ensure proper identification.

- Indicate the year and quarter by completing the 'YR/QTR' section.

- Fill in the 'Period Ending' date to specify the reporting period.

- For line 1, report the total number of covered workers (full and part time) who performed services during or received pay within the payroll period, including the 12th of each month of the quarter.

- On line 2, input the total wages paid for covered employment during the quarter.

- Complete line 3 by deducting wages in excess of $12,960 per covered worker from line 2.

- Calculate taxable wages by subtracting line 3 from line 2 and enter the result on line 4.

- If total wages are less than $50,000, calculate the contribution on line 5A. If they are $50,000 or more, use line 5B to calculate the contribution due based on your annual contribution rate.

- Add any applicable interest and penalties on lines 6A and 6B, then include any previous underpayments on line 6C while deducting any previous overpayments on line 6D.

- Calculate the total payment due by adding lines 5A or 5B, lines 6A, 6B, and 6C, and subtracting line 6D. Enter this amount on line 7.

- Complete the signature section to certify the accuracy of the reported information, ensuring it is signed by an authorized individual (owner, partner, officer, or agent).

- Save changes to the form, and you may also choose to download or print the completed report before submitting it.

Take the next step in managing your contributions by filling out your IL UI-3/40 online today!

Certifying online for unemployment in Illinois requires you to visit the IDES website and log into your account. After logging in, follow the guided steps to certify your eligibility for benefits. Be sure to have your information ready, including your employment history. The IL UI-3/40 can provide insights on your unemployment claims to help you certify accurately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.