Loading

Get Mi Gr-ss-4 - City Of Grand Rapids 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI GR-SS-4 - City Of Grand Rapids online

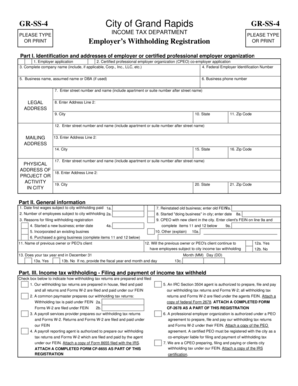

Filling out the MI GR-SS-4 form is a vital step for employers registering for city income tax withholding in Grand Rapids. This guide provides clear, step-by-step instructions to assist users through the online completion of this document.

Follow the steps to fill out the MI GR-SS-4 online.

- To begin, locate the form by using the ‘Get Form’ button. This will open the MI GR-SS-4 in an editable format, enabling you to proceed with the filling process.

- In Part I, provide the identification information for your business. This includes the complete company name, federal employer identification number, and the business’s contact details such as phone number and addresses.

- Continue in Part II by indicating general information regarding your business. State when you first paid wages subject to city withholding and the number of employees affected. Include reasons for registering and provide relevant dates.

- In Part III, select how your withholding tax returns will be managed. Indicate whether these returns are prepared in-house or by an external organization and provide necessary details of the filing agent if applicable.

- Part IV requires you to specify the type of business ownership. Check all relevant boxes that apply to your business structure and ownership.

- Part V identifies each owner, partner, member, or corporate officer associated with the business. Enter their names, titles, and other required personal information in the provided fields.

- In Part VI, include the contact information for the person handling withholding tax inquiries to ensure seamless communication.

- Finally, complete Part VII by having the authorized individual sign, date, and print their name. This validates the application and confirms its accuracy.

- Once you have filled out all required sections, review the form for completeness and accuracy. Users can then save the changes, download, print, or share the completed form as needed.

Start completing your MI GR-SS-4 online today to ensure compliance with city income tax regulations.

Michigan City Income Tax Rates CityState RateTotal City and State RateDetroit4.25%6.65%East Lansing4.25%5.25%Flint4.25%5.25%Grand Rapids4.25%5.75%20 more rows • 1 Jan 2023

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.