Loading

Get Ar Dfa Ar1000cres 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AR DFA AR1000CRES online

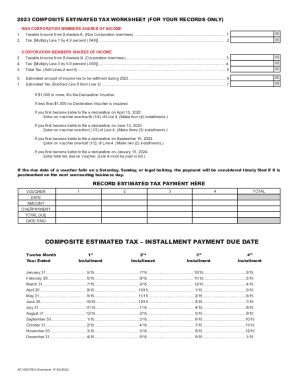

The AR DFA AR1000CRES is a crucial form for individuals and entities subject to the Income Tax Act of 1987 in Arkansas. This guide provides step-by-step instructions on how to successfully complete the online version of the form, ensuring that users can navigate it with confidence.

Follow the steps to accurately complete the AR DFA AR1000CRES.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Begin by entering your Federal Identification Number in the designated field on the form. Ensure that this is accurate, as it will be crucial for processing your voucher.

- Fill out your name, address, city, state, and zip code in the respective fields. This information allows the Department of Finance and Administration to identify your account.

- Indicate the tax year for which you are filing the estimated tax payment by selecting ‘2023’ from the dropdown list or entering it manually.

- Next, specify the due date for your payment. This will generally indicate the date of the first voucher for the estimated tax.

- In the 'Amount of This Payment' field, enter one-fourth of the calculated estimated tax after rounding it to the nearest whole dollar. This amount is based on your Estimated Tax Worksheet.

- If you have overpayments from the prior year that you would like to credit towards this estimated payment, ensure to indicate this on the form as per instructions.

- After confirming all inputted information is correct, review the form for any errors or missing information.

- Finally, save the changes to your form. You can choose to download, print, or share the completed voucher based on your preference.

Start filling out your AR DFA AR1000CRES online today to ensure timely and accurate tax payments.

New users sign up at .atap.arkansas.gov or click on the ATAP link on our web site .dfa.arkansas.gov. ATAP is a web-based service that allows taxpayers, or their designated representative, online access to their tax accounts and related information.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.