Loading

Get Ca Ftb 588 2023-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 588 online

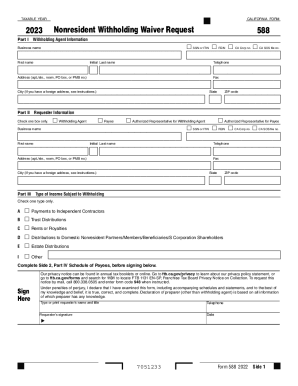

The CA FTB 588 form, also known as the Nonresident Withholding Waiver Request, is essential for individuals and businesses interacting with the California Franchise Tax Board. This guide provides step-by-step instructions for completing the form online, ensuring a smooth and efficient process for all users.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to access the CA FTB 588 document and open it in the editing interface.

- Begin by completing Part I, which includes entering your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), business name, last and first names, Federal Employer Identification Number (FEIN), and California Corporation number or Secretary of State (SOS) file number. Provide your telephone number and complete your address, including your state, city, and ZIP code.

- Proceed to Part II and select one box to identify your status: Withholding Agent, Payee, or Authorized Representative. Fill in the necessary details for this section, including contact information similar to what was required in Part I.

- In Part III, indicate the type of income subject to withholding by checking one box that applies to you, such as Payments to Independent Contractors or Trust Distributions. Ensure to complete this section carefully.

- Complete Side 2, Part IV Schedule of Payees, making sure not to use any personal versions of the Schedule of Payees to report the additional payees, which must be documented directly on this form.

- Finally, finalize your application by signing in the designated area and providing the date of signing. Make sure to double-check all information for accuracy and completeness before proceeding.

- Once completed, you can save your changes, download, print, or share the finalized form as needed.

Start filling out your CA FTB 588 form online today for a seamless experience.

In order to claim exemption from state income tax withholding, employees must submit a W-4 (PDF Format, 100KB)*. or DE-4 (PDF Format, 147KB)* certifying that they did not have any federal tax liability for the preceding year and that they do not anticipate any tax liability for the current taxable year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.