Loading

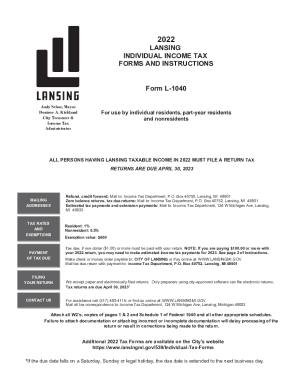

Get Mi L-1040 Instructions - Lansing City 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI L-1040 Instructions - Lansing City online

Filing your income tax return can be a straightforward process when you have clear guidance. This guide will help you navigate the MI L-1040 Instructions for Lansing City, providing comprehensive and user-friendly steps to complete your return efficiently.

Follow the steps to successfully complete your Lansing City tax return.

- Use the ‘Get Form’ button to download the MI L-1040 document and open it in your preferred editor.

- Begin by entering your social security number(s) as required. Ensure that the SSN matches the W-2s you will attach to the return.

- Input your name and, if applicable, your spouse’s name—if you are filing jointly.

- Indicate your current residential address. If using a P.O. Box, provide documentation stating your actual residence.

- Select your filing status by marking the appropriate box. Choose from options such as single, married filing separately, or married filing jointly.

- For residency status, mark the box corresponding to your situation: resident, nonresident, or part-year resident.

- Complete the income section by adding wages, interest, dividends, and all other relevant sources of income as indicated.

- Deduct any allowable items according to the Deductions Schedule on Page 2. Only include expenses that directly correlate with taxable income in Lansing.

- Calculate your exemptions and tax due based on the total income after deductions. Apply the appropriate tax rates for residents or nonresidents.

- Review the form carefully, attach all required documents such as W-2s, and submit your return by the due date, April 30, 2023.

Complete and submit your Lansing City income tax return online today to streamline your filing process.

When filing an amended or corrected return: Include copies of any forms and/or schedules that you're changing or didn't include with your original return. To avoid delays, file Form 1040-X only after you've filed your original return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.