Loading

Get La R-10606 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LA R-10606 online

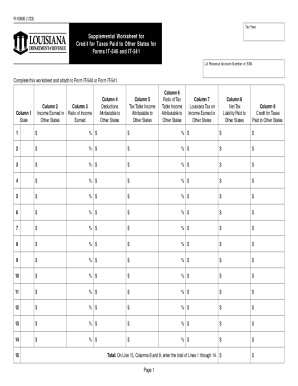

Filling out the LA R-10606 form is essential for Louisiana residents who are claiming a credit for taxes paid to other states. This guide will help you navigate each section of the form to ensure accurate and efficient completion.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ to obtain the form and open it in the editor.

- In Column 1, enter the abbreviation for the state where you earned income. Ensure that the abbreviation is correct to avoid any confusion.

- In Column 2, input the total amount of income that is taxable to the other state and also taxable in Louisiana. This figure should match what is reported in your other state's return.

- For Column 3, calculate the ratio of the income earned by dividing the amount in Column 2 by the amount reported on Form IT-540, Line 7 or Form IT-541, Line 1. Round this percentage to two decimal places.

- In Column 4, determine the deductions attributable to other states by multiplying the deductions claimed on your Louisiana return by the ratio you calculated in Column 3. Round this result to the nearest dollar.

- For Column 5, subtract the figure in Column 4 from that in Column 2 to find the tax table income attributable to other states.

- To calculate Column 6, divide the amount in Column 5 by the relevant Louisiana tax table income indicated on your Form IT-540 or IT-541. Round to two decimal places.

- Column 7 requires you to multiply the ratio from Column 6 by your Louisiana income tax, as found on your tax return.

- In Column 8, input the net tax liability that you reported on the other state's return, with specific exceptions noted for gambling winnings.

- For Column 9, enter the lesser of the amounts from Column 7 or Column 8 for each line. In Line 15, total Lines 1 through 14 and record this in Column 9 as well.

- Finally, after completing all entries, you can save your changes, download, print, or share the completed form as needed.

Complete your documents online efficiently and ensure accurate filing.

Who must file. Louisiana residents, part-year residents of Louisiana, and nonresidents with income from Louisiana sources who are required to file a federal income tax return must file a Louisiana Individual Income Tax Return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.