Loading

Get Az Ador A1-qrt 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AZ ADOR A1-QRT online

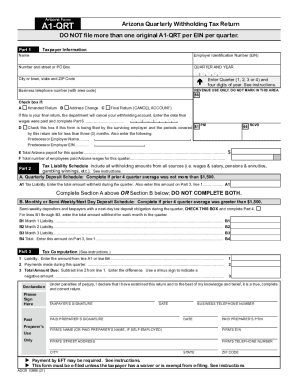

Filling out the AZ ADOR A1-QRT form online is a crucial step for employers to report their quarterly withholding tax. This guide will walk you through each section of the form, ensuring you understand how to provide accurate information efficiently.

Follow the steps to fill out the A1-QRT form properly.

- Click ‘Get Form’ button to obtain the form and open it in your browser.

- In Part 1, enter your taxpayer information, including your name, Employer Identification Number (EIN), address, city, state, and ZIP code. Ensure all information is accurate to avoid issues.

- Select the quarter and year for which you are filing the return. This requires selecting a quarter from 1 to 4 and entering the four-digit year.

- Indicate if the return is an amended return, an address change, or a final return by checking the appropriate boxes. If marking a final return, provide the date final wages were paid.

- In Part 2, report your total Arizona payroll for the quarter and the total number of employees who received Arizona wages.

- Complete the Tax Liability Schedule by indicating your withholding amounts. Depending on your average withholding, choose either the Quarterly Deposit Schedule or the Monthly/Semi-Weekly Deposit Schedule.

- In Part 3, calculate your tax liability, reporting total payments made during the quarter and assessing the total amount due.

- Sign the form in the declaration section to confirm that the information provided is accurate. If using a paid preparer, their signature and information are also required.

- Finally, review your entries, make any necessary adjustments, and save changes. You can print, download, or share the completed form as needed.

Take the first step by filling out the AZ ADOR A1-QRT online today!

Related links form

The department will continue to accept the electronic filing of the Arizona Quarterly Withholding Tax Return (Arizona Form A1-QRT) through AZFSET or through AZTaxes.gov.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.