Loading

Get Ar 2004-6 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AR 2004-6 online

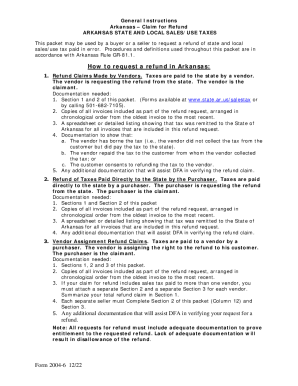

The AR 2004-6 form is crucial for anyone seeking a refund of sales or use tax paid in error in Arkansas. This guide will provide you with detailed instructions on how to fill out this form online, ensuring you have all the necessary information and documentation ready.

Follow the steps to complete your online AR 2004-6 refund request efficiently.

- Press the ‘Get Form’ button to access the AR 2004-6 form and open it in the designated online tool.

- Fill out Section 1: Claim Information. Provide your name, Federal I.D. Number, address, social security number, and other contact details. Specify the period for which you are requesting the refund and the total amount you wish to claim.

- Attach the required documentation as outlined for your category (vendor, purchaser, or vendor assignment). This includes invoices, spreadsheets detailing the taxes remitted, and any additional supporting documentation.

- Complete Section 2, detailing each transaction. Enter the invoice date, vendor name, invoice number, and descriptions. Make sure to provide thorough explanations for any exemptions claimed and ensure all corresponding taxes are listed correctly.

- If you are a vendor assigning the refund, complete Section 3. Ensure the seller's details are filled in, including their sales/use tax permit number and signature.

- Review the entire form for completeness. Ensure that all required fields are filled and that you have included all necessary documentation to avoid rejection.

- Once you finalize the form, save your changes. You can then download, print, or share the document as needed.

Complete your AR 2004-6 refund request online today for a smooth and efficient process.

How far back can a sales tax audit go. The California sales tax audit statute of limitations is 3 years for taxpayers who have filed tax returns. That means the BOE has three years within which they can audit those returns. However, if you fail to file tax returns, the statute of limitations is 8 years.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.