Loading

Get Tn Rv-f1308401 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TN RV-F1308401 online

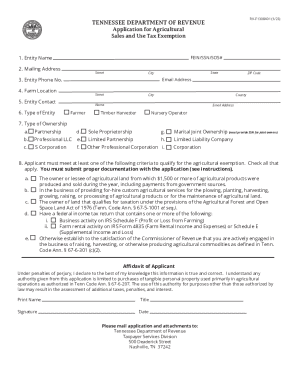

The TN RV-F1308401 form is essential for applying for an agricultural sales and use tax exemption in Tennessee. This guide will help you navigate each section of the form, ensuring that you provide accurate information and submit an effective application online.

Follow the steps to complete your application online.

- Click the ‘Get Form’ button to obtain the TN RV-F1308401 and open it in your browser.

- Enter the entity name in the first section of the form, including the FEIN, SSN, or SOS number. This information is crucial for identifying your application with the appropriate tax identification.

- Fill in the mailing address of your entity, ensuring you provide the street address, city, state, and ZIP code accurately. This will be where any future correspondence will be sent.

- Provide a contact phone number and email address for your entity. This information will be used for follow-up communications related to your application.

- Indicate the farm location by entering the street address details. This helps in verifying the agricultural activity associated with your application.

- Specify the contact name associated with your entity, along with their email address, to clarify inquiries related to the application.

- Select the type of entity from the provided options such as farmer, timber harvester, or nursery operator. This classification determines the nature of your agricultural business.

- Indicate the type of ownership your entity has, choosing from options like partnership, corporation, or sole proprietorship. This helps to categorize your business structure for tax purposes.

- Check all applicable criteria that qualify you for the agricultural exemption in section eight. Make sure to include any necessary documentation as specified in the instructions to support your claims.

- Complete the affidavit of applicant, ensuring to print your name, sign the document, and enter your title and date. This is a declaration of the truthfulness of your application.

- After ensuring all information is accurate, save changes to the form, download a copy for your records, and print it if required for submission. Finally, share the completed application with the Tennessee Department of Revenue, following the mailing instructions provided.

Complete your TN RV-F1308401 application online today to take advantage of the agricultural tax exemption.

Sales and Use Tax Certificate of Exemption This organization or institution qualifies for the authority to make sales and use tax exempt purchases of goods and services that It will use, consume or give away. This authorization for exemption is limited to sales made directly to the referenced organization.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.