Loading

Get Uk Iht403 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK IHT403 online

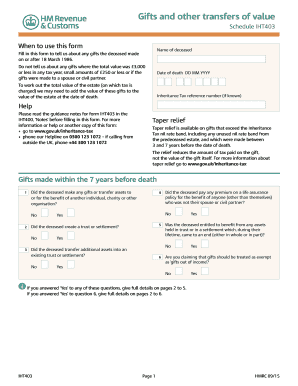

The IHT403 form is a key document for reporting gifts or transfers of value made by the deceased. This guide provides clear instructions for filling out the form online, ensuring that all necessary details are included accurately.

Follow the steps to successfully complete the IHT403 form.

- Press the ‘Get Form’ button to retrieve the form and open it in your preferred editor.

- Fill in the name of the deceased as well as the date of death, ensuring that the date is in DD MM YYYY format.

- Provide the Inheritance Tax reference number, if known, to assist with processing.

- Indicate whether the deceased made any gifts exceeding £3,000 in any tax year since 18 March 1986 and include full details of any applicable gifts.

- Answer the series of yes/no questions regarding trusts or settlements associated with the deceased.

- If any gifts are claimed as exempt as 'gifts out of income', provide these details in the sections indicated.

- Proceed by detailing each gift or asset transfer made by the deceased in the tables provided, including the date, recipient, description, and values.

- Ensure you calculate and provide the total net value after exemptions and reliefs accurately in the specified fields.

- If applicable, fill in information regarding any gifts made with reservation of benefit as instructed on the relevant pages of the form.

- Complete any additional sections for earlier transfers and gifts made as part of normal expenditure out of income if indicated in prior questions.

- Once all sections are filled out thoroughly, save the changes, then download, print, or share the completed form as needed.

Start filling out your IHT403 form online today to ensure accurate reporting of relevant gifts and transfers.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

You can give your son $10,000 in the UK, but it's crucial to understand the tax implications involved. Any gifts above the annual exemption may affect your inheritance tax liability. Handling this correctly can simplify your dealings with the UK IHT403 and minimize potential tax charges.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.