Loading

Get Uk Hs304 Claim Form 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HS304 Claim Form online

This guide provides clear and supportive instructions on completing the UK HS304 Claim Form online. It is designed to help users of all experience levels navigate the form efficiently and accurately.

Follow the steps to complete the UK HS304 Claim Form online.

- Click the ‘Get Form’ button to access the UK HS304 Claim Form and open it in the editing tool of your choice.

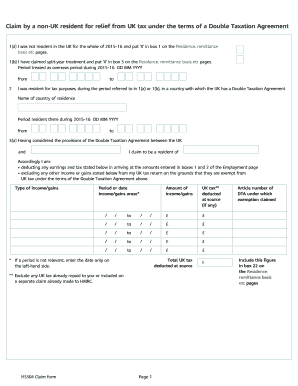

- Begin by filling out section 1(a) or 1(b) regarding your residency status for the year 2015-16. Indicate whether you were not resident for the entire year or if you have claimed split-year treatment by marking the appropriate box.

- In section 2, specify the country where you were resident during the relevant period. You will need to provide the name of that country and the duration of your residency.

- Complete section 3(a) by confirming your residency status under the Double Taxation Agreement. List the income you are claiming relief for, providing details such as type of income, dates income was earned, and any UK tax deducted at source.

- In section 3(b), if applicable, claim partial relief for specific income items. Fill out the gross amount and applicable tax rates, making sure to include the total partial relief claimed.

- Answer question 4 about any prior relief requests submitted to HMRC, marking 'Yes' or 'No' as appropriate.

- Proceed to complete questions 5(a) and 5(b) regarding your full or partial relief claims, and confirm your status if you were born before 6 April 1948.

- Fill in the declaration section affirming that you are entitled to the declared income and that all information is correct. Sign and date the form.

- Once you have completed the form, review all entries for accuracy and completeness. After verification, save your changes, and download or print the form as needed.

Complete your UK HS304 Claim Form online today for efficient tax relief processing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, a US resident can potentially claim the UK personal allowance, but eligibility depends on several factors, including residency status and income sources. Generally, if you meet specific criteria, you can benefit from tax relief. It’s advisable to check with a tax professional or directly with HM Revenue and Customs to understand your eligibility. Using the UK HS304 Claim Form can simplify the process, helping you navigate your rights effectively.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.