Loading

Get Uk Hmrc Sa900 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HMRC SA900 online

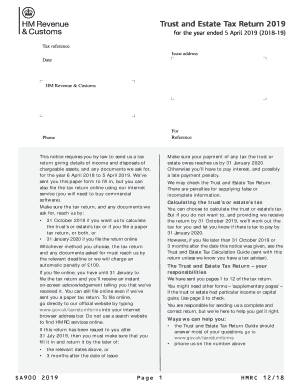

The UK HMRC SA900 form, also referred to as the Trust and Estate Tax Return, is essential for trustees and personal representatives to report income and gains for the trust or estate. This guide will provide you with step-by-step instructions to complete the form accurately online.

Follow the steps to fill out the UK HMRC SA900 form online.

- Press the ‘Get Form’ button to access the SA900 form and open it in your preferred editor.

- Begin with Section 1: Determine if you need to answer all questions. If you are the trustee of a bare trust or a personal representative of a deceased, check if the conditions apply that allow skipping certain questions and mark the relevant box.

- In Step 2, answer Questions 1 to 7 and Question 23 to ascertain if supplementary pages are needed. Use the Trust and Estate Tax Return Guide for assistance in answering these questions accurately.

- Proceed to enter details regarding income and capital gains under the designated sections, ensuring that all figures are rounded to the nearest pound and filled using blue or black ink, as required.

- Complete any supplementary pages if necessary based on earlier answers. You can obtain these pages online.

- In Step 3, answer all required questions concerning the administration of the trust. Ensure to indicate the nature of the trust, if it is relevant to other specific tax rules.

- Conclude the form by reviewing all sections for accuracy. After verifying all entries, sign and date the declaration at the end of the form, certifying that the information is correct to the best of your knowledge.

- Lastly, submit the completed form online by following the submission instructions, and save any acknowledgment or confirmation received.

Ensure that your tax returns are submitted on time by completing documents online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

If you manage a trust in the UK, you likely need to complete a trust tax return online. This return accounts for income generated by the trust and any associated tax obligations. Using the UK HMRC SA900 can streamline this process and help ensure that you meet all the necessary requirements without confusion.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.