Loading

Get Uk Hmrc C2001 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HMRC C2001 online

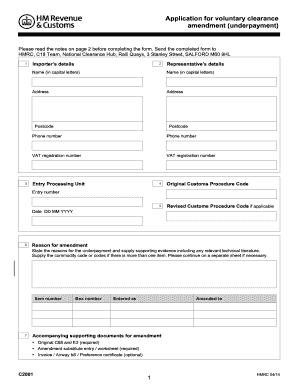

The UK HMRC C2001 form is essential for individuals seeking to apply for voluntary clearance amendments concerning underpayments. This guide provides you with clear instructions on how to accurately complete the form online, ensuring your submission is successful.

Follow the steps to fill out the UK HMRC C2001 form online effectively.

- Press the ‘Get Form’ button to access the form and open it in the online editor.

- Enter the importer’s details, including the name (in capital letters), address, postcode, phone number, and VAT registration number.

- Fill in the representative’s details in the same manner, ensuring all information is accurately provided.

- Provide the entry processing unit information, including the original customs procedure code and any revised customs procedure code if applicable.

- Include the entry number and the date of entry in the required format (DD MM YYYY).

- State the reasons for the underpayment in detail, and ensure to attach any supporting evidence such as relevant technical literature and commodity codes if necessary.

- Input the item number and the box number, indicating the amounts entered as well as the amended amounts.

- Detail the amount of underpayment as indicated in question 6, including breakdowns of duty, VAT, and other amounts.

- If applicable, supply full details for deferment payment and ensure you provide the specific authority from the consignee for any amendments.

- Complete the declaration by providing your name (in capital letters), phone number, signature, and the date (DD MM YYYY).

- Once all sections are filled out, you can save changes, download, print, or share the completed form.

Start filling out the UK HMRC C2001 form online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The C18 HMRC form is used for notifying the tax authority about changes to tax codes or income reports. While the C2001 HMRC focuses on your departure, the C18 plays a role in updating your tax status. Both forms are valuable for maintaining clear communication with the UK HMRC regarding your tax responsibilities.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.