Loading

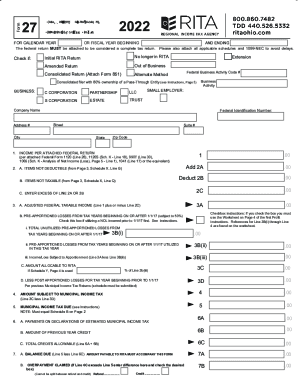

Get 1 Add 2a Deduct 2b 2c 3a 3c 3d 4 5 6a 6b 6c 7a 7b 3b(ii ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1 Add 2A Deduct 2B 2C 3A 3C 3D 4 5 6A 6B 6C 7A 7B 3B(ii) online

Filling out the 1 Add 2A Deduct 2B 2C 3A 3C 3D 4 5 6A 6B 6C 7A 7B 3B(ii) form online can be a straightforward process when you follow the right steps. This guide aims to assist you in carefully completing each section of the form with ease and confidence.

Follow the steps to successfully fill out the form online.

- To begin, click the ‘Get Form’ button to obtain the form and open it in the editing interface.

- Review the sections of the form and gather the necessary information, including business details like your Federal Identification Number and company name.

- Complete Line 1 by entering the income as stated on your attached federal return (e.g., Form 1120 or equivalent).

- For Line 2A, provide details of items that are non-deductible as listed in Schedule X. Enter the total amount directly.

- Fill in Line 2B to indicate additional deductions and compute Line 2C as instructed.

- Calculate the adjusted federal taxable income for Line 3A, factoring in any applicable deductions or additions.

- If applicable, check the box related to pre-apportioned losses from tax years after 1/1/17 for Line 3B, and provide the required figures in any subsequent fields.

- Continue filling out the remaining lines (from Lines 4 through 7B), using the prompts and instructions as guides for each section.

- Once you finish, review all entered information for accuracy. You may then save your changes, download a copy, or prepare the form for printing or sharing.

Start completing your form online today for a smoother filing experience.

Related links form

This is a non-cash expense that the Internal Revenue Service (IRS) allows you to deduct from your taxable income, effectively creating a "paper loss." The paper loss shows up on the K-1 tax form you receive from the property and can often be used to offset your W-2 income. Let's consider a practical example.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.