Loading

Get Instructions For Form It-201, Full-year Resident Income ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

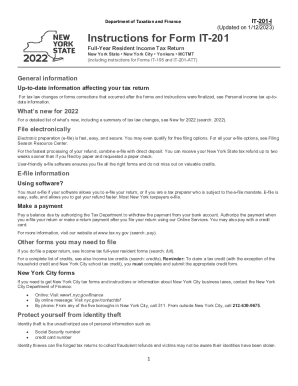

How to fill out the instructions for Form IT-201, Full-Year Resident Income Tax Return online

Filing your income tax return can be daunting, but understanding how to properly complete Form IT-201 will help simplify the process. This guide provides step-by-step instructions tailored for users filling out the form online.

Follow the steps to complete the online submission of Form IT-201.

- Press the 'Get Form' button to access the IT-201 form.

- Complete the taxpayer information section by filling in your name, address, date of birth, and Social Security number accurately.

- Select your filing status and complete the additional items from B through H concerning your dependency status.

- Enter your federal income and any necessary adjustments in the designated lines, ensuring whole dollar amounts only.

- Calculate your New York additions and subtractions based on your income and provide the amounts as indicated.

- Determine your deductions by comparing the New York standard deduction and itemized deduction, and enter the appropriate amount.

- Compute your New York State tax using either the tax table or tax rate schedules based on your income.

- Fill out the voluntary contributions and payments credits sections to reflect any applicable credits.

- Review the total amounts you owe or refund due, then select your preferred method of payment or refund allocation.

- Sign and date your return and ensure all supplementary forms are attached, if necessary, before submitting.

- Finally, save your completed form, and choose to download, print, or share your submission as needed.

Complete your income tax documents online today for a hassle-free filing experience.

Related links form

You are a New York State resident if your domicile is New York State OR: you maintain a permanent place of abode in New York State for substantially all of the taxable year; and. you spend 184 days or more in New York State during the taxable year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.