Loading

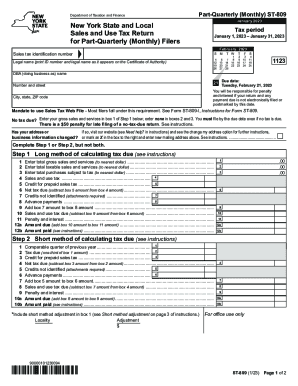

Get Form St-809 New York State And Local Sales And Use Tax Return For Part-quarterly (monthly) Filers

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form ST-809 New York State And Local Sales And Use Tax Return For Part-Quarterly (Monthly) Filers online

Filling out the Form ST-809 for New York State and Local Sales and Use Tax is essential for part-quarterly (monthly) filers. This guide provides a step-by-step process to help users accurately complete the form online, ensuring compliance and timely submission.

Follow the steps to complete the Form ST-809 accurately online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your sales tax identification number in the designated field to ensure proper tracking of your tax return.

- Specify the tax period for which you are filing, noting that this example is for January 1, 2023 – January 31, 2023.

- Fill in your legal name and DBA (doing business as) name as it appears on your Certificate of Authority.

- Provide your business address, including the number and street, city, state, and ZIP code.

- If your business information has changed, mark the appropriate box and provide your new information, following the instructions.

- Choose between Step 1 or Step 2 to determine the method of calculating tax due; do not complete both.

- For Step 1 (Long method), enter your total gross sales in Box 1, total taxable sales in Box 2, and total purchases subject to tax in Box 3.

- Calculate the sales and use tax in Box 4 and any credits for prepaid sales tax in Box 5, proceeding to determine the net tax due in Box 6.

- For Step 2 (Short method), begin with the comparable quarter information from the previous year and follow a similar process to calculate the tax due.

- Complete the remaining boxes for credits, advance payments and penalties, and finalize your amount due.

- Sign and date the return, ensuring all necessary details such as designee’s name and contact information are provided before submission.

- Save your changes, and make sure to download or print a copy for your records after you have finalized the form.

Start completing your Form ST-809 online today to ensure timely and accurate filing.

Related links form

File online with Sales Tax Web File Log in to (or create) your Business Online Services account. Select the ≡ Services menu in the upper-left corner of your Account Summary homepage. Select Sales tax - file and pay, then select Sales tax web file from the expanded menu.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.