Loading

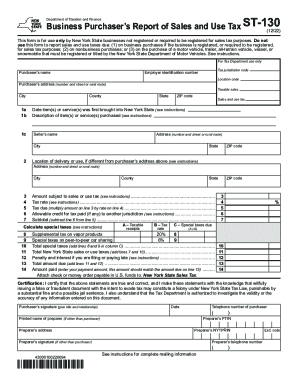

Get Form St-130 Business Purchaser's Report Of Sales And Use Tax Revised 12/22

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form ST-130 Business Purchaser's Report Of Sales And Use Tax Revised 12/22 online

Filling out the Form ST-130 is essential for New York State businesses not registered for sales tax purposes. This form enables you to report sales and use tax accurately online, ensuring compliance with state tax regulations.

Follow the steps to complete the form online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the purchaser’s name in the designated field. This should be the legal name of the business or individual making the purchase.

- Next, input the tax jurisdiction code, which identifies the tax area where your business is located.

- Fill in the employer identification number, an essential identifier for tax purposes.

- Provide the location code, if applicable, which may be necessary for your reporting.

- Enter the purchaser’s address, including the number and street or rural route, city, county, state, and ZIP code.

- In the taxable sales section, specify the total dollar amount of taxable sales made.

- Indicate the date the item(s) or service(s) were first brought into New York State in the corresponding field.

- Describe the item(s) or service(s) purchased. Be specific to ensure clarity in the transaction.

- Next, fill out the seller's name and address, including the city, state, and ZIP code.

- If delivery or use of the items differs from the purchaser’s address, provide those details as well.

- In the amount subject to sales or use tax section, list the monetary amount that is liable for tax.

- Enter the applicable tax rate that corresponds to the amount subject to tax.

- Calculate the tax due by multiplying the amount on the previous line by the tax rate.

- If applicable, include any allowable credit for tax paid to another jurisdiction.

- Subtract the allowable credit from the tax due to determine the subtotal.

- If special taxes apply, calculate these based on the given instructions for specific rates.

- Add the special taxes to the total sales or use taxes to find the total tax obligation.

- Finally, enter any penalties or interest charges applicable for late filing and payments.

- Complete the certification section, ensuring all statements are true and correct. Sign and date it next.

- Lastly, you can save changes, download, print, or share the filled-out form as needed.

Complete your Form ST-130 online today for seamless tax reporting.

Sales and use tax rates in New York State reflect a combined statewide rate of 4%, plus the local rate in effect in the jurisdiction (city, county, or school district) where the sale or other transaction or use occurs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.