Loading

Get Mo 53-v 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO 53-V online

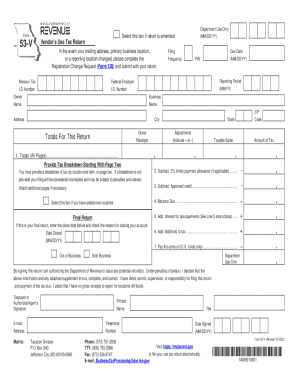

Filling out the MO 53-V, the Vendor’s Use Tax Return, can seem daunting, but with the right guidance, it can be a straightforward process. This guide will provide you with step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the MO 53-V online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin by entering your Missouri Tax I.D. Number and Federal Employer I.D. Number in their respective fields. If you do not have these numbers, ensure you complete the necessary registration processes before proceeding.

- Fill in the Filing Frequency and Due Date. If you are unsure about the filing frequency, you may leave it blank. The Due Date can be found on the Missouri Department of Revenue's tax calendar.

- Provide the Owner’s and Business Name, along with the full Address, including City, State, and ZIP Code. If there are any changes to your mailing or business locations, be sure to complete the Registration Change Request (Form 126) and attach it.

- In Line 1, Totals (All Pages), enter the sum of total gross receipts, any adjustments, taxable sales, and tax due for all pages of your return. Each page must include a detailed breakdown by business location. If necessary, attach additional pages.

- If applicable, check the box to indicate that you have added new locations. Provide the required details for these locations in the breakdown on page two.

- When calculating the Balance Due in Line 4, subtract any timely payment allowance (Line 2) and approved credits (Line 3) from your total tax amount.

- For Line 5, if your payment is late, calculate interest due based on the number of days past the due date. Refer to the provided examples to guide your calculations.

- In Line 6, include any additions to tax based on late filing or payments. Calculate as instructed, ensuring to understand the implications of filing late.

- For Line 7, sum up the total amount due, including the balance, interest, and additions to tax. Prepare to send your payment accordingly.

- Complete the signature section, ensuring that it is dated. The individual signing must have direct control or responsibility for the filing.

- Once all sections are filled, you can save the form, download it for your records, print it, or share it as needed.

Complete your Vendor’s Use Tax Return online today to ensure compliance and avoid potential penalties.

Any social, civic, religious, political subdivision, or educational organization can apply for a sales tax exemption by completing Form 1746PDF Document, Missouri Sales Tax Exemption Application. This form lists the information needed to verify the organization is indeed a tax-exempt non-profit organization.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.