Loading

Get Proposed Collection; Requesting Comments On Form 1097-btc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Proposed Collection; Requesting Comments On Form 1097-BTC online

Filling out the Proposed Collection; Requesting Comments On Form 1097-BTC online is a straightforward process that requires attention to detail. This guide will assist you in completing the form accurately and efficiently, ensuring you meet your reporting obligations.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to acquire the form and open it for editing.

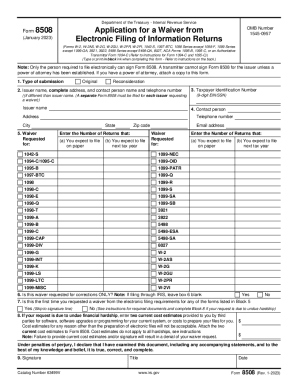

- Indicate the type of submission by selecting either the 'Original' or 'Reconsideration' option in Block 1.

- In Block 2, provide the issuer's full name, address, and the name and contact number of a person to reach for further information if different from the issuer.

- Enter the nine-digit taxpayer identification number (EIN or SSN) in Block 3.

- Complete Block 5 by checking the box(es) beside the forms for which you are requesting a waiver, including any relevant number of returns expected to be filed on paper.

- Identify in Block 6 if the waiver is requested solely for corrections.

- In Block 7, indicate whether this is your first waiver request; if not, be prepared to attach justifications in Block 8.

- If you are claiming undue financial hardship in Block 8, provide cost estimates from two knowledgeable parties regarding the costs associated with meeting electronic filing requirements, and attach that documentation.

- In Block 9, sign and date the form. Ensure that the signature is made by the taxpayer or an authorized person, as required.

- Finalize by saving the form. You can then download, print, or share it as necessary.

Start completing your documents online today to ensure compliance.

Get federal tax forms Download them from IRS.gov. Order online and have them delivered by U.S. mail. Order by phone at 1-800-TAX-FORM (1-800-829-3676)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.