Loading

Get Sc Dor Sc 990-t 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR SC 990-T online

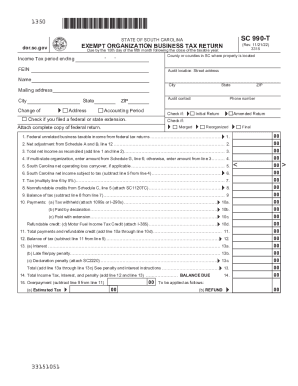

Filing the SC DoR SC 990-T is crucial for organizations in South Carolina reporting unrelated business income. This guide will take you through each step to complete the form accurately and efficiently in an online format.

Follow the steps to complete the SC DoR SC 990-T form online.

- Press the ‘Get Form’ button to access the SC DoR SC 990-T form and open it in the designated online editor.

- Provide your organization’s Federal Employer Identification Number (FEIN) at the top of the form. This identifier is necessary for filing tax returns.

- Enter your organization’s name, mailing address, and city, ensuring to accurately state the state and ZIP code. Additionally, indicate the county or counties in South Carolina where your property is located.

- Complete the income tax period ending date field. Ensure that this date aligns with your organization’s financial year.

- Indicate if you filed a federal or state extension and attach a complete copy of your federal return if applicable. This information assists in verifying your records.

- Fill in the income figures starting from line 1 as stated in section 1 of the form. Include the federal unrelated business taxable income from federal tax returns.

- Proceed to rate the net adjustment from Schedule A and B, and add all entries to calculate the total net income as required in line 3.

- If you are a multi-state organization, ensure you complete the specified schedules and report the necessary figures on line 4.

- Calculate the South Carolina net income subject to tax on line 6, which entails subtracting any net operating loss carryover from the determined income amount.

- Complete the tax calculation on line 7 by multiplying the amount on line 6 by the applicable tax rate.

- Provide any nonrefundable credits and summarize the payments made, as directed in subsequent lines.

- Calculate any penalties or interest applicable and total the Income Tax, interest, and penalties as shown in the final sections of the form.

- Before submission, review all entries for accuracy. Save changes, and choose to download, print, or share the completed form as required.

Complete your SC DoR SC 990-T online today for a seamless reporting process.

You may be charged a penalty if: you did not pay at least 90% of the total tax due. How to calculate your underpayment: The underpayment of any installment is the difference between the amount of your required installment and any payments you made by the due date of the installment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.