Loading

Get Sc Dor I-290 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR I-290 online

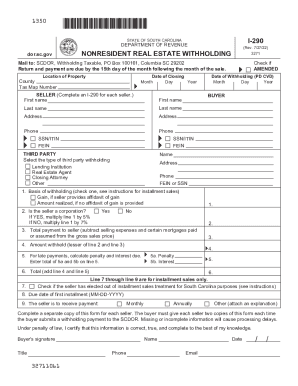

The SC DoR I-290 form is essential for nonresident real estate withholding in South Carolina. This guide provides comprehensive steps to complete the form accurately online, ensuring compliance with state requirements.

Follow the steps to fill out the SC DoR I-290 correctly.

- Click the ‘Get Form’ button to obtain the SC DoR I-290 form and open it in your preferred editing tool.

- Fill in the location of the property, date of closing, and county where the property is situated. This information is crucial for proper processing.

- Enter the seller's information, including first name, last name, address, phone number, and either SSN, ITIN, or FEIN. Complete a separate I-290 for each seller involved.

- Input the buyer's information. Include their name, contact details, and SSN, ITIN, or FEIN.

- Indicate the date of withholding by choosing the appropriate month, day, and year.

- Specify the third-party withholding type by selecting from options such as lending institution, real estate agent, or closing attorney.

- Complete the basis of withholding section. Choose whether to calculate based on gain provided by the seller or amount realized without an affidavit.

- Determine if the seller is a corporation. Indicate 'yes' or 'no' and apply the correct withholding percentage based on your selection.

- Enter the total payment to the seller by subtracting any selling expenses and mortgages from the gross sales price.

- Calculate the amount to withhold, which is the lesser of the amount on line 2 and line 3.

- If applicable, calculate any penalties and interest due for late payments and input the total.

- Finalize by ensuring all fields are accurately filled, then save your changes, download the completed form, and print or share it according to your needs.

Complete your SC DoR I-290 form online today to ensure timely submission and compliance.

State Capital Gains Tax Rates RankStateRates 202318South Carolina *6.40%19Iowa *6.00%20Rhode Island5.99%21New Mexico *5.90%47 more rows

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.