Loading

Get Mn Wnb Financial Consumer Loan Application 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN WNB Financial Consumer Loan Application online

Filling out the MN WNB Financial Consumer Loan Application online can be a straightforward process if you follow the appropriate steps. This guide aims to provide clear and comprehensive instructions to ensure you complete the application accurately and efficiently.

Follow the steps to complete your loan application online.

- Click ‘Get Form’ button to access the application and open it in your document editor.

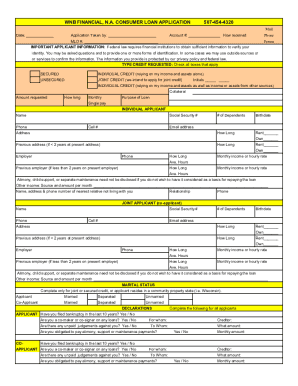

- Begin by entering the date of your application at the top of the form. Next, provide the name of the individual taking the application and the corresponding account number.

- Indicate the method through which the application was received by selecting the appropriate option.

- Fill out the applicant's information, including their name, Social Security number, number of dependents, birthdate, current address, previous address (if applicable), phone numbers, and email address.

- Provide employment details for the applicant by including the employer's name, contact number, duration of employment, monthly income or hourly rate, and average hours worked per week. Include the same details for a previous employer if applicable.

- If there is any additional income, specify the source and the amount received each month. Also, include the name, address, relationship, and contact number of a nearest relative not living with the applicant.

- For a joint applicant, repeat the information collection process as performed for the primary applicant, ensuring all details are entered accurately.

- Complete the marital status section if the loan is joint or secured. Indicate ‘Married’, ‘Separated’, or ‘Unmarried’ for both the applicant and joint applicant.

- Answer the declarations for each applicant regarding bankruptcy, loans, unpaid judgments, and any alimony or maintenance payments that may affect the loan.

- List your assets and liabilities in the provided sections, including any necessary details for property, accounts, and outstanding loans.

- Verify all information entered is accurate and complete before proceeding to the signature section.

- Finally, sign and date the application for both the applicant and co-applicant, confirming that the information provided is true to the best of your knowledge.

- Once finished, save your changes, and choose to download, print, or share the completed application as required.

Begin your application online today to secure your financial future efficiently.

The routing number is the nine-digit number printed in the bottom left corner of each check. Your specific account number (usually 10 to 12 digits) is the second set of numbers printed on the bottom of your checks.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.