Loading

Get Ct Form Ct-6559a 2009-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT Form CT-6559A online

Filling out the CT Form CT-6559A online is a straightforward process. This guide will walk you through each section of the form, ensuring you complete it accurately and efficiently.

Follow the steps to successfully complete the CT Form CT-6559A online.

- Click the ‘Get Form’ button to acquire the form and open it in a suitable editor.

- Begin by entering the year for which the compact discs are submitted. This helps to identify the reporting period.

- Input the submitter’s Connecticut tax registration number, ensuring it is accurate to avoid processing issues.

- Provide the submitter’s federal employer identification number (FEIN). This number is essential for tax processing.

- Fill in the name and complete address of the submitter. Include street address, PO box, city, state, and ZIP code for proper identification.

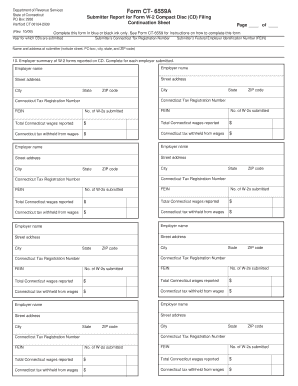

- For each employer reported on the compact disc, complete the employer summary of W-2 forms. Enter the employer's name, address, Connecticut tax registration number, and FEIN.

- Indicate the number of W-2 forms submitted for each employer to ensure accurate reporting.

- Enter the total Connecticut wages reported for each employer. Use numerical values only, without symbols.

- Provide the amount of Connecticut tax withheld from wages for each employer. Again, use numerical values.

- Repeat steps 6 through 9 for each employer as needed. Once all necessary information is filled out, review the form for completeness and accuracy.

- Save your changes, then download, print, or share the completed form as required.

Complete your CT Form CT-6559A online today for accurate and efficient filing.

Here's how it works Send ct form 941 via email, link, or fax. You can also download it, export it or print it out. Draw your signature, type it, upload its image, or use your mobile device as a signature pad. Send ct form 941 via email, link, or fax. Ct 941: Fill out & sign online - DocHub DocHub https://.dochub.com › Forms Library DocHub https://.dochub.com › Forms Library

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.