Loading

Get Wi Gcu Income Tax Preparation Client Information Questionnaire 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI GCU Income Tax Preparation Client Information Questionnaire online

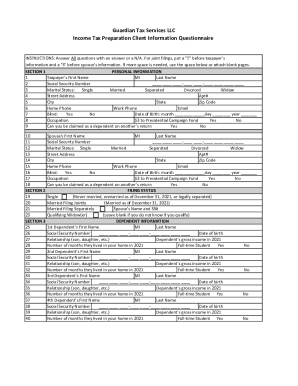

Completing the WI GCU Income Tax Preparation Client Information Questionnaire is an essential step in preparing your income tax return. This guide provides clear, step-by-step instructions to help you fill out the form accurately and efficiently, ensuring that all necessary information is gathered for your tax preparation needs.

Follow the steps to complete your questionnaire online with ease.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- In Section 1, input your personal information, including your first and last name, social security number, marital status, and contact details. Ensure accuracy as this information is critical for your tax return.

- Still in Section 1, provide your occupation, date of birth, and indicate whether you are blind or can be claimed as a dependent on another person's return. If applicable, repeat this information for your spouse by entering their details clearly marked with 'S'.

- In Section 2, choose your filing status. You may select from options including single, married filing jointly, or qualifying widow(er). Make sure to select the status that accurately reflects your situation.

- Proceed to Section 3, where you will enter information about your dependents. For each dependent, fill in their name, social security number, date of birth, relationship, gross income, and length of stay in your home. Be thorough to avoid errors.

- In Section 4, indicate whether you received any IRS health insurance documents and provide details if any member of your tax family lacked coverage during any month of the tax year.

- Now, continue to Section 5. Answer questions regarding your income sources. This includes social security benefits, interest income, dividends, and child care expenses. Accurately report the amounts as they will affect your overall tax calculation.

- In Section 6, answer general questions about your dependents, student status, and whether you filed tax returns in previous years. Here you’ll also provide information about any back taxes or child support.

- Finally, review all sections for completeness and accuracy. Once satisfied, save your changes, and you may choose to download, print, or share the completed form according to your needs.

Complete the WI GCU Income Tax Preparation Client Information Questionnaire online today.

Related links form

Income tax surveys are conducted to identify the taxpayer who has not properly filed income tax returns despite receiving taxable income, and thereby prompting the assessees to pay the requisite taxes along with the penalty or interest, as the case may be.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.