Loading

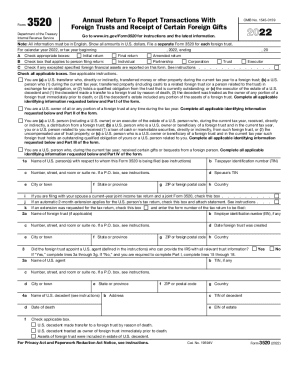

Get About Form 3520, Annual Return To Report Transactions With Foreigninstructions For Form 3520

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the About Form 3520, Annual Return To Report Transactions With Foreign Instructions For Form 3520 online

The About Form 3520 is an essential document for reporting transactions with foreign trusts and receiving certain foreign gifts. This guide provides a step-by-step approach to completing the form online, ensuring clarity and accuracy.

Follow the steps to successfully complete your About Form 3520.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Identify your filing status by checking the appropriate boxes at the top of the form. This includes options for initial, amended, or final return, as well as your status as an individual, corporation, partnership, or trust.

- Fill out the identifying information for the U.S. person with respect to whom Form 3520 is being filed. This includes providing the name, taxpayer identification number (TIN), address, and other pertinent details.

- Complete Part I of the form, detailing any transfers by U.S. persons to a foreign trust during the current tax year. Provide information about the trust creator, the address, and governance details.

- If applicable, provide documentation and details regarding any obligations related to a foreign trust, which includes completing Schedule A concerning obligations of a related trust.

- If you made gratuitous transfers to the trust, continue to Schedule B to detail any transfers made without adequate consideration.

- For distributions you received from a foreign trust, complete Part III, which covers distributions to a U.S. person from a foreign trust during the current tax year.

- If you received any gifts or bequests from foreign persons, fill out Part IV, which gathers details about gifts exceeding certain thresholds.

- Once all sections are completed accurately, review the form for any errors or missing information.

- Save your changes, download the completed form, and if necessary, print or share the document as required.

Complete your About Form 3520 online today to ensure compliance with IRS regulations.

U.S. persons (and executors of estates of U.S. decedents) file Form 3520 to report: Certain transactions with foreign trusts. Ownership of foreign trusts under the rules of sections Internal Revenue Code 671 through 679. Receipt of certain large gifts or bequests from certain foreign persons.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.