Loading

Get Ma State Tax Form 96 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA State Tax Form 96 online

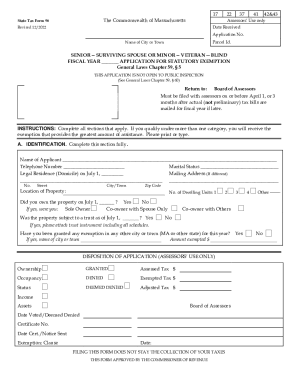

Filling out the Massachusetts State Tax Form 96 online is an important process for those seeking statutory exemptions for property taxes. This guide provides concise, step-by-step instructions to support users in completing the form accurately and efficiently.

Follow the steps to fill out the MA State Tax Form 96 online.

- Press the ‘Get Form’ button to access the MA State Tax Form 96 and open it for editing.

- Begin with Section A, Identification. Fill in your name, telephone number, marital status, legal residence as of July 1, and mailing address if it differs from your legal residence. Also, provide the location of property and confirm ownership details.

- In Section B, Exemption Status, check all applicable statuses such as being a veteran, blind person, senior, or surviving spouse. Provide additional details as requested in the subsections.

- Proceed to Section C if you are a senior. Complete your gross receipts information, including any retirement benefits, wages, or other income.

- In Section D, indicate the value of all property owned as of July 1 of the current year. Include real estate, personal estate, and any other assets.

- Finally, in Section E, sign and date the application to certify its accuracy. If an agent is signing, be sure to attach a copy of their signed authorization.

- Once all sections are completed, save your changes, download a copy for your records, and print or share the form as needed.

Start filling out your MA State Tax Form 96 online to ensure you meet the exemption application deadline.

You must be 70 or older. For Clauses 41C and 41C½, the eligible age may be reduced to 65 or older, by vote of the legislative body of your city or town. You must own and occupy the property as your domicile.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.