Loading

Get Irs 2220 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 2220 online

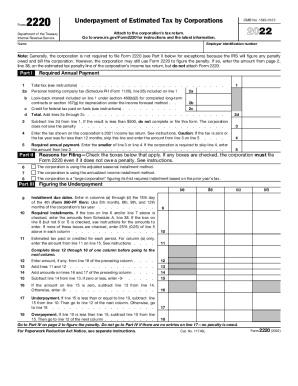

Filling out the IRS 2220 is essential for corporations that may face penalties for underpayment of estimated tax. This guide offers clear, step-by-step instructions to help users complete this form efficiently online, ensuring compliance and accuracy in their tax obligations.

Follow the steps to complete the IRS 2220 accurately.

- Press the ‘Get Form’ button to access the IRS 2220 form and open it in your editor.

- Enter the employer identification number in the designated field. This is a unique number assigned to your corporation by the IRS.

- Provide the corporate name as it appears on the tax return.

- Complete Part I by calculating the required annual payment. Add the total tax, personal holding company tax, look-back interest, and any credits for federal tax paid on fuels.

- On line 3, enter the tax shown on the corporation's previous year's income tax return. If applicable, skip to line 5.

- For line 4, enter the smaller of the previous amount (line 3) or the calculated amount on line 4. This represents the required annual payment.

- In Part II, check any relevant boxes that apply to situations necessitating the filing of the form, even if no penalty is owed.

- Move to Part III to figure the underpayment. Enter the due dates for installments and any estimated tax paid or credited for each period.

- Complete lines 12 through 18 for each column systematically, ensuring you carry over data correctly from preceding columns.

- Proceed to Part IV if applicable, to calculate any penalties. Follow the instructions closely and enter the penalty amount as required.

- Once all sections are completed, ensure to save your changes, download the form, or share it with relevant stakeholders.

Start filling out your IRS 2220 online today to ensure timely compliance and avoid penalties.

For non-compliance of all these points, under Section 272A, a penalty of Rs. 10,000 will be levied for each instance/ failure. (6) Late Filing of TDS Return- In case the taxpayer with TAN fails to file TDS return by the due date, a penalty of Rs. 200 daily is imposed until the tax return is filed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.