Loading

Get Oh Odt It 3 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OH ODT IT 3 online

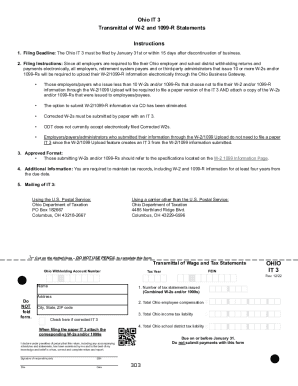

Filling out the OH ODT IT 3 form is essential for employers who are required to report their W-2s and 1099-Rs. This guide will provide clear, step-by-step instructions to help you complete the form efficiently and accurately.

Follow the steps to complete the OH ODT IT 3 form online.

- Click ‘Get Form’ button to obtain the form and open it for editing. This will allow you to interact with the necessary fields on the document.

- Enter your Ohio withholding account number in the designated field at the top of the form. This number can be found on previous tax documents.

- Provide the name of your organization or business in the name field. Ensure that the name entered matches official documentation to avoid discrepancies.

- Fill in the complete address, including street address, city, state, and ZIP code. Accurate information is crucial for proper processing.

- Enter your Federal Employer Identification Number (FEIN) in the specified area. This number is vital for establishing your business identity.

- For the tax year, specify the year for which you are submitting the W-2s and 1099-Rs. This is typically found on the documents being reported.

- Fill in the total Ohio employee compensation amount in the appropriate field, ensuring your figures are accurate and correspond to the attached statements.

- Complete the total Ohio school district tax liability and total Ohio income tax liability fields, as these figures should reflect the accurate totals from your records.

- If you are submitting a corrected IT 3, check the box indicated on the form. This ensures that the correct filing status is acknowledged.

- Sign and date the form in the designated area. This confirmation is crucial to affirm the accuracy of the information provided.

- Before submitting, review all entered information for accuracy. Once confirmed, you can save changes, download, print, or share the completed form as required.

Complete your forms online today to ensure timely and accurate submissions.

Individual IT 40P/IT 40XP payment coupon with paymentOhio Department of Taxation PO Box 182131 Columbus, Ohio 43218-2131IT 1040 without paymentOhio Department of Taxation PO Box 2679 Columbus, Ohio 43270-2679IT 1040 with paymentOhio Department of Taxation PO Box 2057 Columbus, Ohio 43270-205710 more rows • 8 May 2020

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.