Loading

Get Irs 637 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 637 online

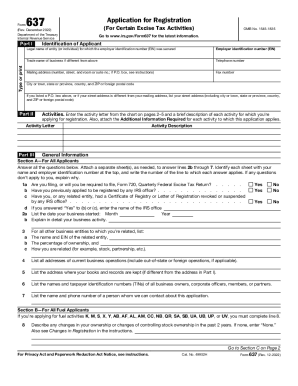

Filling out the IRS 637 form is essential for those applying for registration for certain excise tax activities. This guide provides clear, step-by-step instructions to assist users in completing the form online accurately and efficiently.

Follow the steps to complete the IRS 637 form online.

- Use the ‘Get Form’ button to access the IRS 637 form. This will allow you to obtain the necessary document in an editable format.

- In Part I, provide identification details including your legal name, employer identification number (EIN), trade name (if applicable), contact details, and mailing address. Ensure this information is accurate to avoid delays.

- Complete Part II by entering the appropriate activity letters from the provided chart along with a brief description of each activity for which registration is sought.

- In Part III, Section A, answer all questions thoroughly. If additional space is needed, attach separate sheets labeled with your name and EIN, making sure to reference the specific line number.

- Fill out Section B specifically for fuel applicants if applicable by providing a description of ownership changes in the past two years, using ‘None’ if there have been no changes.

- For Section C, respond to the questions pertinent to fuel activities as directed. If you answer ‘Yes’ to any questions, provide a detailed explanation on additional sheets.

- Review your completed form to ensure all information is correct and complete. Sign the form where indicated and provide your title and date.

- Finally, save changes to your document. You can download, print, or share your completed IRS 637 form as required.

Start filling out your form online today to ensure compliance and registration for your excise tax activities.

Use Form 637, Application for Registration (For Certain Excise Tax Activities), to apply for registration for activities under IRC sections 4101, 4222, 4662 and 4682. Form 637 contains a description of each activity letter. A person can register for more than one activity on Form 637, if applicable.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.