Loading

Get Ca Schedule X 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA Schedule X online

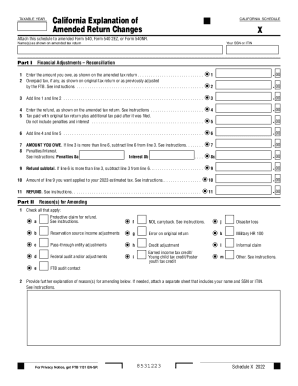

The California Schedule X is an essential form for individuals amending their tax returns. This guide provides clear and comprehensive steps on how to fill out the form online, ensuring a smooth filing process for users.

Follow the steps to successfully complete your CA Schedule X online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your name(s) as they appear on the amended tax return in the designated field at the top of the form.

- Input your social security number (SSN) or individual taxpayer identification number (ITIN) in the appropriate box.

- In Part I, provide the financial adjustments for reconciliation. Start with the amount owed from your amended tax return and enter it on line 1.

- Next, if applicable, enter any overpaid tax from your original return on line 2.

- Add the amounts from line 1 and line 2, and record the total on line 3.

- Enter any refund amount from the amended return on line 4.

- On line 5, indicate the total tax paid with the original return and any additional payments made post-filing, excluding penalties and interest.

- Sum the values from lines 4 and 5, entering the total on line 6.

- Determine the amount you owe by subtracting line 6 from line 3, provided line 3 exceeds line 6, and enter the result on line 7.

- If applicable, include any penalties and interest in sections 8a and 8b.

- If line 6 exceeds line 3, subtract line 3 from line 6 to find your refund subtotal and write it on line 9.

- If you wish to apply part of your refund to the next year's estimated tax, denote this amount on line 10.

- Finally, complete the refund section on line 11 by indicating the total refund amount you expect to receive.

- In Part II, check all applicable reasons for amending your return, and provide additional explanations as needed.

- Once all fields are completed, review your form for accuracy and completeness, then save your changes.

- You can then download, print, or share your completed form as necessary.

Start filling out your CA Schedule X online today for a seamless amendment process.

You can now file Form 1040-X electronically with tax filing software to amend 2019 or later Forms 1040 and 1040-SR, and 2021 or later Forms 1040-NR. For more details, see our June 2022 news release on this topic. Paper filing is still an option for Form 1040-X.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.