Loading

Get Oh It 1040 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OH IT 1040 online

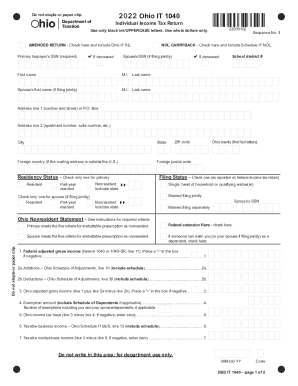

Filling out the OH IT 1040 form online can streamline the tax filing process for individuals and couples residing in Ohio. This guide will provide clear, step-by-step instructions to ensure the successful completion of your income tax return while maximizing accuracy and compliance.

Follow the steps to fill out the OH IT 1040 online effectively.

- Click ‘Get Form’ button to access the OH IT 1040 form.

- Complete the primary taxpayer's sections, including entering your Social Security Number (SSN) and checking applicable boxes if relevant, such as for deceased status or Nonresident definitions.

- Fill in your address details accurately, making certain to use whole dollars only and only black ink in UPPERCASE letters.

- Indicate your residency status and filing status by selecting the appropriate options.

- Enter your Federal adjusted gross income (line 1), and include any required Ohio adjustments in the subsequent lines for additions or deductions detailing needed schedules.

- Calculate your Ohio adjusted gross income and exemptions, ensuring all amounts are placed in the correct fields.

- Determine your tax liability based on your calculated income and any available credits, entering these values on the respective lines.

- If applicable, include any information regarding nonrefundable and refundable credits using the appropriate schedules.

- Lastly, review all sections for accuracy and completeness, then save your changes, download the form, or print it for submission.

Complete your OH IT 1040 form online for a more efficient and effective filing experience.

IT 1040 Tax Return 2022 Ohio IT 1040 Individual Income Tax Return - Includes Ohio IT 1040, Schedule of Adjustments, IT BUS, Schedule of Credits, Schedule of Dependents, IT WH, and IT 40P. FILE ONLINE Fill-In.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.