Loading

Get Irs 1040 - Schedule H 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 - Schedule H online

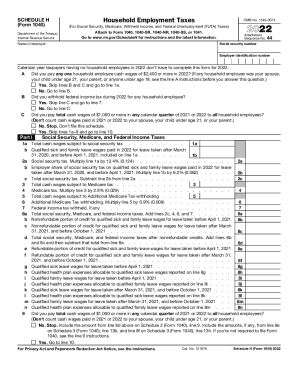

This guide provides a detailed walkthrough of how to complete the IRS 1040 - Schedule H form online. Whether you are new to tax preparation or just need a refresher, this guide will help you navigate each section and field with confidence.

Follow the steps to fill out the IRS 1040 - Schedule H with ease.

- Press the ‘Get Form’ button to obtain the form and open it for completion.

- Begin by entering your social security number, followed by the name of the employer. Ensure that the employer identification number is also filled in accurately.

- Determine if you paid any one household employee cash wages of $2,400 or more in 2022. If yes, skip lines B and C and go to line 1a.

- If no, proceed to line B. This section asks if you withheld federal income tax during 2022 for any household employee.

- If the answer to line B is yes, skip line C and go to line 7. If no, read line C carefully to determine if you paid total cash wages of $1,000 or more in any calendar quarter of 2021 or 2022 to all household employees.

- If the answer to line C is no, you do not need to file this schedule. If yes, skip lines 1a through 9 and continue to line 10.

- For Part I, include the total cash wages subject to social security tax on line 1a, any qualified sick and family leave wages on line 1b, and then calculate the associated social security and Medicare taxes.

- Proceed to complete the federal income tax withheld on line 7, if applicable, and total the amounts on line 8a.

- In Part II, answer the unemployment tax questions honestly, and complete the appropriate sections based on your responses.

- Lastly, if applicable, complete Part IV with the required address and signature information and ensure that your form is thoroughly reviewed.

- Once all sections are complete, save your changes, download, print, or share the form as necessary.

Start filling out your IRS 1040 - Schedule H online today for a smoother tax filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Most household employers must file Schedule H and pay household employment taxes by April 18 each year.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.