Loading

Get Fl Dr-482 2023-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL DR-482 online

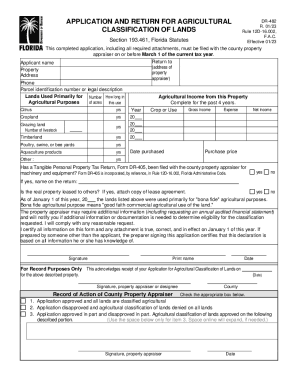

The FL DR-482 is an essential document for applying for agricultural classification of lands in Florida. Completing this form accurately helps ensure that your property is classified correctly, potentially affecting your tax obligations.

Follow the steps to complete the FL DR-482 online.

- Press the ‘Get Form’ button to access the FL DR-482 and open it for editing.

- Begin by entering your name in the 'Applicant name' field, followed by the 'Property address' where the agricultural land is located.

- Provide your phone number in the designated field to facilitate communication with the county property appraiser.

- Fill out the 'Parcel identification number or legal description' section to identify your property accurately.

- Indicate the lands used primarily for agricultural purposes and the number of acres for each type, such as citrus, cropland, grazing land, timberland, etc.

- Record how long each type of land has been used primarily for agricultural purposes and provide the income generated from these uses over the past four years.

- Answer whether a Tangible Personal Property Tax Return (Form DR-405) has been filed with the county property appraiser for machinery and equipment by selecting 'yes' or 'no.'

- If the property is leased to others, check the appropriate box and attach a copy of the lease agreement as required.

- Certify that the lands were primarily used for 'bona fide' agricultural purposes by signing and dating the form.

- Review all information provided for accuracy, then save any changes, download the completed form, print it, or share it as necessary.

Start completing your FL DR-482 online to ensure your agricultural classification is handled efficiently.

Florida Statute 193.461 is commonly referred to as the “Greenbelt Exemption”. Under this statute, farm properties that are used for bona fide agricultural activities are to be taxed based on the current “use” value of the property–$500 per acre—versus its development value, which is typically much higher.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.