Loading

Get Irs 5330 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 5330 online

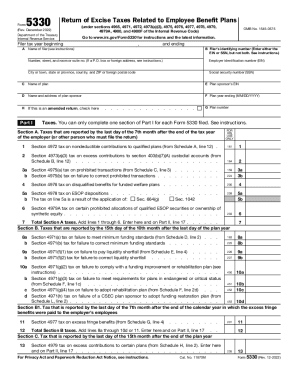

Filling out the IRS Form 5330 is essential for reporting excise taxes related to employee benefit plans. This guide is designed to provide clear, step-by-step instructions to assist users in successfully completing the form online.

Follow the steps to complete the IRS Form 5330 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the tax year information in section A, including the beginning and ending dates.

- Fill out the filer’s identifying number; enter either the Employer Identification Number (EIN) or Social Security Number (SSN).

- Input the name of the filer, along with their address, including city, state, and ZIP code.

- Provide the name of the plan and the plan sponsor’s EIN.

- Complete the plan year ending date in the designated field.

- If applicable, mark the box indicating this is an amended return.

- Proceed to Part I and select the appropriate section based on the relevant excise tax to report.

- For each applicable section (A through F), input the required tax amounts based on the provided schedules.

- Complete Part II by entering the total tax due and any prior tax payments if applicable.

- Sign and date the form in the appropriate areas, ensuring all information is accurate.

- After reviewing the form for completeness, save your changes and download or print the completed Form 5330.

Complete your IRS 5330 online today to ensure compliance with excise tax requirements.

Related links form

Filling Out the Right Forms After remitting the late deposits and making the additional contributions to cover lost earnings, plan sponsors should complete the Internal Revenue Service (IRS) Form 5330 and pay the excise tax—equal to 15 percent of the lost earnings. The excise tax cannot be paid from the plan assets.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.