Loading

Get Irs 8453-fe 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

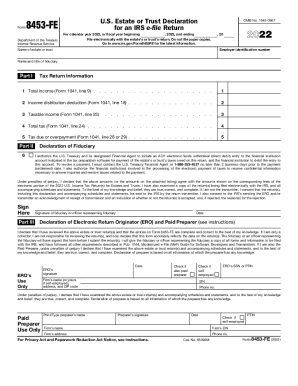

How to fill out the IRS 8453-FE online

Navigating the IRS 8453-FE form can seem daunting, but this guide aims to provide clear and concise instructions for users of all experience levels. By following these steps, you can efficiently complete the form online and ensure that your estate or trust tax return is submitted correctly.

Follow the steps to easily complete the IRS 8453-FE form online.

- Click the ‘Get Form’ button to access and display the form in your editor.

- Enter the employer identification number at the top of the form to identify the estate or trust.

- Provide the name of the estate or trust, followed by the name and title of the fiduciary responsible.

- In Part I, fill in the tax return information: start with total income from Form 1041, line 9, and continue with the income distribution deduction from line 18, taxable income from line 23, and total tax from line 24.

- Next, complete line 5 with the tax due or overpayment from Form 1041, line 28 or 29.

- For Part II, check the box if you authorize an ACH electronic funds withdrawal for tax payment, ensuring the appropriate financial information is provided.

- In the declaration section, the fiduciary or an authorized officer must sign and date the form to validate all provided information.

- If applicable, the Electronic Return Originator (ERO) must complete their section, signing and including their Preparer Tax Identification Number (PTIN) if they are also the paid preparer.

- Finally, review all entries for accuracy, then save your changes, download, print, or share the completed form as necessary.

Complete your IRS 8453-FE form online today and ensure your estate or trust tax return is filed accurately.

Form 1041, U.S. Income Tax Return for Estates and TrustsPDF, is used by the fiduciary of a domestic decedent's estate, trust, or bankruptcy estate to report: Income, deductions, gains, losses, etc.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.