Loading

Get Ma Dor 355sbc 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA DoR 355SBC online

Filing the MA DoR 355SBC form online is crucial for small business corporations in Massachusetts to comply with tax regulations. This guide provides comprehensive steps to ensure a smooth and accurate submission process.

Follow the steps to complete the form efficiently.

- Click ‘Get Form’ button to obtain the MA DoR 355SBC form and open it for editing.

- Enter the name of the corporation as registered in Massachusetts. This should match the official documents to avoid any discrepancies.

- Fill in the Federal Identification Number (FID). This is essential for tax identification purposes and must be accurate.

- Provide the principal business address, ensuring that the city/town, state, and zip code are correctly filled in to avoid miscommunication with tax authorities.

- Indicate the kind of business by selecting from the available options. This helps in categorizing your business for tax evaluation.

- Enter the date of charter in Massachusetts. This is the official date your corporation was formed.

- Input the average number of employees in Massachusetts during the taxable year. This statistic is vital for determining applicable taxes.

- Check the applicable boxes regarding the type of return being filed, such as 'Amended return' or 'Final return'. This indicates the context of your filing.

- Proceed to fill in the financial computations for taxable property and income as per the guidelines provided on the form.

- After completing all sections, review the entire form for accuracy. Make sure all required fields are completed.

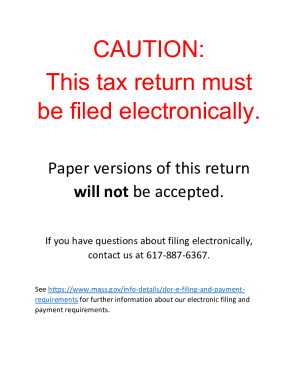

- Finally, save your changes, download a copy of the completed form, and print it for your records or share as necessary.

Take the next step towards compliance by completing your MA DoR 355SBC form online today.

Massachusetts Form 355 Excise Tax includes a tax of $2.60 per $1,000 on taxable Massachusetts tangible property or taxable net worth, whichever applies, and a tax of 8.0% on income attributable to Massachusetts.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.