Loading

Get Ma 355sc 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA 355SC online

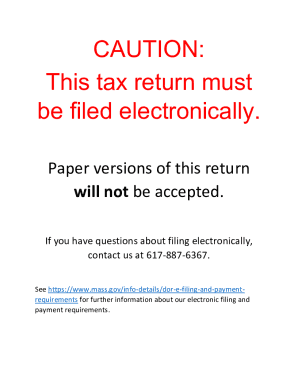

The MA 355SC is the Security Corporation Excise Return for Massachusetts. It is essential to complete this form accurately when filing electronically to ensure compliance with state tax regulations.

Follow the steps to complete the MA 355SC online.

- Press the ‘Get Form’ button to access the MA 355SC form and open it in your preferred editor.

- In the first section, enter the name of the corporation, U.S. Principal Business Code, and the Federal Identification number. Ensure all details are correct, as this information verifies your corporation's identity.

- Fill in the principal address of the corporation, including the city/town, state, and zip code. This should reflect the official location of your corporation's operations.

- Indicate the applicable boxes for status updates such as whether it is an amended return or if the corporation is a Class 1 or Class 2 security corporation.

- Provide the date of incorporation as well as the state or country of incorporation. This establishes the legal foundation of your corporation.

- Complete the section on the average number of employees in Massachusetts and any additional boxes that may pertain to audits or disclosures.

- For the computation of excise, enter total U.S. income and state-municipal bond interest as guided and work through the excise calculations step-by-step.

- Attain confirmations of your corporation's financials as required in the balance sheet section, ensuring that all assets and liabilities are properly documented.

- Complete the ownership information section if applicable, detailing any significant holdings by entities or other corporations.

- Review all entries for accuracy and completeness before proceeding to save your work.

- After verifying your details, utilize the options to save changes, download, print, or electronically submit the completed form.

Complete your MA 355SC form online to ensure timely and accurate filing.

Two parts make up the excise tax regulations for Massachusetts corporations and LLC's. First, there is a 0.26 percent tax on tangible property, and second, there is an 8.75 percent tax on net income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.