Loading

Get Form 1099-int (rev. January 2022) - Irs Tax Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

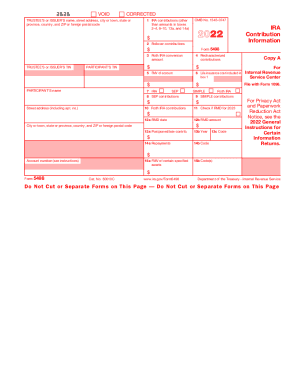

How to fill out the Form 1099-INT (Rev. January 2022) - IRS Tax Forms online

Filling out Form 1099-INT online is an essential task for reporting interest income to the IRS. This guide will provide you with a clear, step-by-step approach to ensure you complete the form accurately and efficiently.

Follow the steps to successfully complete your Form 1099-INT.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter the trustee's or issuer's name, street address, city or town, state or province, country, and ZIP or foreign postal code in the respective fields.

- Input the participant's name and taxpayer identification number (TIN) in the appropriate sections.

- Enter the total IRA contributions you made for the year in Box 1, ensuring to include only amounts that are not covered in boxes 2–4.

- Fill out Box 2 for any rollover contributions made during the year.

- Report any Roth IRA conversion amounts in Box 3 appropriately.

- Complete Box 4 for any recharacterized contributions transferred from one type of IRA to another.

- Indicate the fair market value (FMV) of the account in Box 5.

- If applicable, enter the life insurance costs in Box 6.

- For boxes 7 through 10, include any contributions made to SEP and SIMPLE IRAs as necessary.

- Check the box if there is a required minimum distribution (RMD) for the year in Box 11 and provide the RMD date and amount in Boxes 12a and 12b.

- Fill in any late rollover contributions in Box 13 and provide the year credited in Box 13b.

- Complete Box 14 for any repayments of qualified distributions, including the appropriate codes.

- If applicable, summarize the FMV of certain specified assets in Box 15.

- Once all fields are completed, review your entries for accuracy, then save changes, download, print, or share the completed form as needed.

Complete your tax documents online and ensure your submissions are accurate and timely.

The Bottom Line On the other hand, receiving a Form 1099-INT often means a taxpayer has taxable interest income it must report on its Federal income tax return. Internal Revenue Service. "Instructions for Forms 1099-INT and 1099-OID (01/2022)."

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.