Loading

Get Nh Dor Bt-summary 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NH DoR BT-SUMMARY online

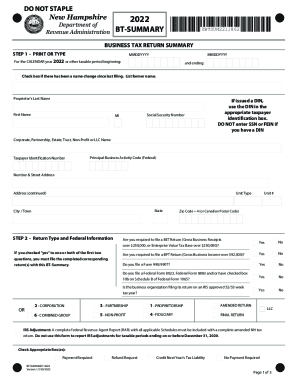

Filling out the NH Department of Revenue Administration BT-SUMMARY form can seem daunting, but this guide will provide clear and supportive instructions to help you navigate the process seamlessly. Whether you are a sole proprietor or part of a business organization, following these steps will ensure that you complete the form accurately.

Follow the steps to complete the BT-SUMMARY form effectively.

- Click ‘Get Form’ button to obtain the BT-SUMMARY and open it in your preferred online editor.

- Start with step 1 where you need to print or type your information. Enter the calendar year and the period for which you are filing. Check the box if there has been a name change since the last filing and provide the former name.

- For step 2, indicate if you are required to file a Business Enterprise Tax return and a Business Profits Tax return, checking 'Yes' or 'No' accordingly. Answer other questions about federal forms and the type of business organization accurately.

- In step 3, complete the BET and/or BPT return(s) as required, and then finish the BT-SUMMARY, ensuring that the corresponding returns are attached.

- Make sure to calculate your total balance due correctly, including any additions to tax that may apply. If applicable, indicate any refund request or application of overpayment to the next year's tax liability.

- Step 5 involves signing the document under penalties of perjury. Ensure to provide all required signatures and information for both the taxpayer and any paid preparer, if applicable. Finally, save your changes and prepare to either download or print the completed form for submission.

Complete your NH DoR BT-SUMMARY online today to ensure timely filing and compliance.

As of 2023, the Business Profits Tax rate is 7.6%, assessed on gross income over $92,000 (the rate will drop to 7.5% starting in 2024). File the Business Profits Tax with Form NH-1065. Business Enterprise Tax can be used as a credit towards the Business Profits Tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.